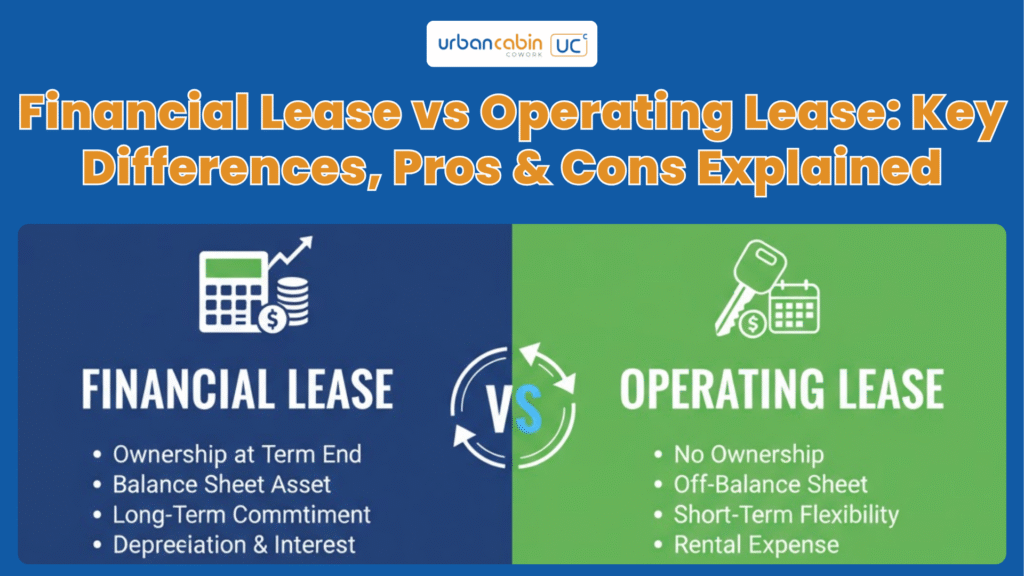

Financial Lease vs Operating Lease: Key Differences, Pros & Cons Explained

Financial Lease vs Operating Lease

What is a Financial (Finance) Lease?

A financial lease (sometimes called a capital lease) is a leasing arrangement in which substantially all the risks and rewards of ownership of an asset are transferred to the lessee. The lessee, in effect, gets many of the benefits (and obligations) of owning the asset, without legally owning it until possibly a future purchase.

Key features of a financial lease include:

- The lessee often ends up with ownership at lease end (via a bargain purchase option).

- Lease term generally covers most of the asset’s useful life.

- The present value of lease payments is close to, or exceeds, the fair value of the asset.

- The lessee often bears responsibilities such as maintenance, insurance, and repair.

In many jurisdictions (including under older accounting standards), that means the lessee capitalizes the leased asset in their books, depreciates it, and recognizes interest on the lease liability.

Under modern accounting standards like IFRS 16, the distinction between financial lease vs operating lease is less clear for lessees (since most leases are recognized on the balance sheet) — though differences still exist in how the expense is recognized.

What is an Operating Lease?

An operating lease is a lease in which the lessor retains the risks and rewards of ownership, and the lessee primarily pays for the right to use the asset for a lease term shorter than the asset’s useful life.

Characteristics of an operating lease include:

- The lessee pays rental payments, but does not take on depreciation or residual value risk.

- The lease term is shorter (often much shorter) relative to the useful life of the asset.

- No transfer of ownership at the end of lease term, and no bargain purchase option.

- The lessor usually handles maintenance, insurance, and residual risk.

Under older accounting standards, operating leases were often off the books for lessees (i.e. recognized in disclosures, not on the balance sheet). But with IFRS 16 / Ind AS 116, lessees now recognize a “right-of-use” (ROU) asset and lease liability even for what would formerly have been called operating leases.

Financial Lease vs Operating Lease: 7 Key Differences

| Aspect | Financial Lease | Operating Lease |

|---|---|---|

| Ownership | Often transfers to lessee (or strong option) | Remains with lessor |

| Term relative to life | Usually spans major part of asset life | Shorter lease term |

| Present value of payments | Close to or above fair value | Much lower relative to fair value |

| Risk & rewards | Lessee bears most risks & rewards | Lessor retains risk of residual value |

| Maintenance / insurance | Usually lessee’s responsibility | Usually lessor handles these |

| Accounting | Capitalize asset, depreciate, interest expense | Under older rules: straight-line lease expense; under IFRS 16: ROU asset + lease liability |

| Flexibility | Less flexible, longer commitment | More flexible, easier to switch assets |

This side‑by‑side helps illustrate the financial lease vs operating lease distinction and aids decision making. Use this knowledge when deciding whether to lease or buy, and which lease structure is ideal.

Accounting Treatment of Leases (IFRS 16 & Ind AS / Modern Standards)

One of the biggest shifts in lease accounting arrived with IFRS 16, which largely eliminates the off‑balance-sheet treatment of operating leases for lessees. Now, lessees must record a right-of-use (ROU) asset and a lease liability for nearly all leases (except short-term or low-value exemptions).

Under IFRS 16 / Ind AS 116 (the Indian equivalent), the old classification between finance lease vs operating lease for the lessee is essentially collapsed into a single lessee accounting model, though lessors still distinguish between finance vs operating leases.

Why the change?

- To bring greater transparency and comparability in financial statements

- To avoid “off-balance-sheet financing” via operating leases that hide obligations

Under the new model, even leases that would have been classified traditionally as “operating leases” must often be capitalized and depreciated, with interest recognized on lease liability.

However, lessors still must classify each lease as either an operating lease or finance lease for their reporting: if the lease transfers substantially all the risks and rewards of ownership, it’s a finance lease; otherwise, it’s operating.

To summarize: for lessees under IFRS 16 / Ind AS 116, the financial lease vs operating lease distinction is less material in terms of balance sheet presence, but still matters in expense recognition, risk structure, and cash flow patterns.

Pros and Cons of Financial Lease

✅ Pros of Financial Lease

- Predictable long-term control and use of the asset

- Potential to gain ownership at the end (bargain purchase)

- Depreciation benefits and interest expense deductions (depending on tax regime)

- Better for assets with long useful life and stable usage

❌ Cons / Risks of Financial Lease

- Long-term commitment may reduce flexibility

- Depreciation, maintenance, repairs, and residual risk borne by lessee

- Cash flow burden due to fixed payments and interest

- If usage falls short, you may pay more than the asset’s useful life

These are the pros and cons of financial lease you should weigh when considering leasing decisions.

Pros and Cons of Operating Lease

✅ Pros / Advantages of Operating Lease

- Greater flexibility to change or upgrade assets

- No risk of residual value loss

- No responsibility for maintenance or insurance (often)

- Usually less upfront cost and commitment

❌ Cons / Disadvantages of Operating Lease

- Lack of ownership and equity in the asset

- Higher cost over long-term, as lessee never accrues residual value

- Less control over the asset

- Under older rules, off-balance-sheet risk (but less with IFRS 16)

These are the operating lease advantages and disadvantages businesses should consider.

Financial Lease vs Operating Lease in India: What Businesses Should Know

In India, accounting rules have evolved. Ind AS 116, which is largely aligned with IFRS 16, replaces the old Ind AS 17. Under Ind AS 116, lessees must recognize almost all leases on the balance sheet, effectively removing the traditional operating lease vs finance lease distinction for lessees.

Some important points for Indian businesses:

- Short-term leases and low-value assets are exempt (i.e., can be treated like operating leases).

- Under older standards (AS 19 / Ind AS 17), classification criteria included transfer of ownership, lease term relative to useful life, present value of payments, etc.

- Tax treatment differs: for example, depreciation claims, interest deduction rules, and treatment under the Income Tax Act may still depend on classification in some cases.

- Startups and small businesses need to carefully review lease terms before deciding between financial lease vs operating lease in India, as commitments and risks differ.

When Should You Choose a Financial vs Operating Lease?

Use these guidelines to pick the right lease type:

- Choose financial lease when you plan to use the asset for its full life, want long-term control, and need tax benefits.

- Opt for operating lease when you value flexibility, want to avoid residual risk, or plan to upgrade technology frequently.

- Consider hybrid or short-term leases when usage is uncertain.

- Evaluate the lease strategy, total cost of ownership, and impact on balance sheet/cash flows.

- For businesses in India, check how Ind AS 116 / IFRS 16 rules, tax laws, and finance cost will apply.

Final Thoughts: Choosing the Right Lease Type for Your Business

The difference between financial lease and operating lease boils down to risk, control, cost structure, and long-term strategy. Under modern accounting standards, the traditional line is blurred for lessees, but lease structure still impacts cash flows, tax, and flexibility.

In India, under Ind AS 116, most leases are capitalized and recognized on balance sheet. That means less emphasis on whether a lease is “finance” or “operating” — though the underlying contractual terms and obligations still matter.

When deciding, ask:

- How long will you use the asset?

- Do you want ownership or flexibility?

- Can you bear maintenance and residual risk?

- How will tax, accounting, and cash flows be affected?

Making the right choice between financial lease vs operating lease can influence your firm’s financial health and strategic agility.

About Urban Cabin Coworking – Premium Coworking Space in Central Delhi

Urban Cabin Coworking is a modern, fully-equipped coworking space located in the heart of Central Delhi, offering a dynamic, flexible, and inspiring work environment for freelancers, startups, entrepreneurs, and remote teams.

Strategically situated near Pusa Road, Karol Bagh, and Rajendra Place, our coworking solutions include private cabins, fixed desks, flexi desks, day passes, part-time access, and virtual office plans — all tailored to your unique business needs.

Whether you’re looking to scale your startup, meet clients professionally, or simply get out of the home-office rut, Urban Cabin Coworking provides:

✅ High-speed WiFi

✅ Ergonomic furniture

✅ Soundproof meeting rooms

✅ Cafeteria & unlimited tea/coffee

✅ 24/7 CCTV security

✅ Metro connectivity

✅ Community events & networking

Join a vibrant community of professionals and enjoy the perfect blend of affordability, accessibility, and productivity — with zero commitment and free trial options available.

📍 Address: 11B/8, Pusa Rd, Old Rajinder Nagar, Delhi 110005

📞 Contact: 080-6906-9498

🌐 Website: www.urbancabincowork.com

📧 Email: connect@urbancabincowork.com

Urban Cabin Cowork – Your Space to Create, Collaborate & Grow.

FAQs – Financial Lease vs Operating Lease

What is the main difference between financial lease and operating lease?

Financial lease transfers most risks and rewards of ownership to lessee; operating lease retains such risks with the lessor.

Which lease type is better for startups?

Startups often prefer operating leases for flexibility and lower long-term commitment.

How are financial and operating leases treated under IFRS 16?

Under IFRS 16, lessees account for nearly all leases by recording a right-of-use asset and lease liability, blurring the traditional distinction for lessees.

Is a capital lease the same as a financial lease?

Yes — “capital lease” is a classic term used in some jurisdictions that corresponds to what we call a financial lease.

Can you switch a lease from operating to financial?

Lease reclassification may occur if contract changes or renegotiation triggers reassessment under standards, but it depends on terms and accounting rules.

Leave a Reply